All Categories

Featured

Table of Contents

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your hectic life, economic freedom can appear like an impossible objective.

Pension plan, social protection, and whatever they would certainly taken care of to conserve. It's not that very easy today. Less employers are offering typical pension strategies and several companies have actually reduced or discontinued their retirement plans and your capability to rely only on social safety and security remains in question. Also if advantages haven't been reduced by the time you retire, social security alone was never intended to be adequate to spend for the way of life you want and are entitled to.

Currently, that might not be you. And it is necessary to recognize that indexed universal life has a lot to supply individuals in their 40s, 50s and older ages, along with people who wish to retire early. We can craft a service that fits your specific circumstance. [video: An illustration of a man appears and his wife and child join them.

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Now, suppose this 35-year-old guy requires life insurance policy to protect his household and a means to supplement his retirement earnings. By age 90, he'll have obtained practically$900,000 in tax-free revenue. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And must he die around this time, he'll leave his survivors with greater than$400,000 in tax-free life insurance policy benefits.< map wp-tag-video: Text boxes appear that read"$400,000 or even more of security"and "tax-free earnings through plan finances and withdrawals"./ wp-end-tag > In fact, throughout all of the accumulation and dispensation years, he'll obtain:$400,000 or more of protection for his heirsAnd the opportunity to take tax-free revenue with plan car loans and withdrawals You're probably asking yourself: How is this possible? And the response is simple. Interest is connected to the performance of an index in the securities market, like the S&P 500. The money is not straight invested in the stock market. Interest is attributed on an annual point-to-point sections. It can provide you more control, versatility, and options for your economic future. Like many individuals today, you may have access to a 401(k) or various other retirement plan. And that's a terrific primary step towards saving for your future. Nevertheless, it is essential to comprehend there are limitations with certified plans, like 401(k)s.

Top Iul Carriers 2020

And there are constraints on when you can access your cash without penalties. [video: Text boxes appear that read "limits on contributions", "restrictions when accessing money", and "money can be taxable".] And when you do take money out of a qualified plan, the cash can be taxed to you as earnings. There's a good factor a lot of individuals are transforming to this unique solution to fix their economic objectives. And you owe it to on your own to see exactly how this could help your very own individual scenario. As part of a sound economic approach, an indexed universal life insurance plan can aid

Indexed Universal Life Insurance Pros And Cons

you tackle whatever the future brings. And it provides one-of-a-kind potential for you to develop significant cash money worth you can use as extra earnings when you retire. Your cash can expand tax postponed via the years. And when the plan is created appropriately, circulations and the survivor benefit will not be taxed. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is very important to speak with a specialist agent/producer that recognizes exactly how to structure a service like this properly. Before dedicating to indexed global life insurance, here are some advantages and disadvantages to think about. If you choose a great indexed global life insurance policy plan, you might see your cash money worth grow in worth. This is valuable since you might have the ability to gain access to this money prior to the plan expires.

Universal Life Guaranteed Rate

Because indexed universal life insurance needs a particular level of risk, insurance policy business often tend to keep 6. This type of plan likewise supplies.

Normally, the insurance policy business has a vested interest in doing much better than the index11. These are all factors to be considered when selecting the finest type of life insurance for you.

New York Life Indexed Universal Life Insurance

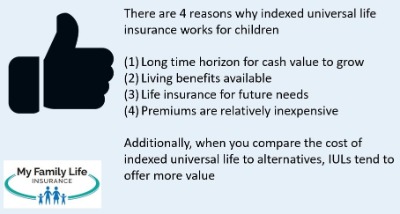

Considering that this kind of plan is much more intricate and has an investment component, it can commonly come with greater costs than other policies like whole life or term life insurance policy. If you don't think indexed universal life insurance coverage is right for you, right here are some options to consider: Term life insurance policy is a momentary plan that generally supplies protection for 10 to thirty years.

When making a decision whether indexed global life insurance policy is best for you, it is essential to consider all your options. Entire life insurance policy may be a much better choice if you are looking for more stability and consistency. On the various other hand, term life insurance might be a better fit if you just need protection for a certain time period. Indexed global life insurance policy is a sort of policy that supplies much more control and flexibility, in addition to greater money value growth potential. While we do not supply indexed universal life insurance policy, we can provide you with more details about entire and term life insurance coverage plans. We suggest discovering all your alternatives and talking with an Aflac agent to discover the most effective suitable for you and your household.

The remainder is included to the cash money value of the plan after charges are subtracted. The cash money worth is credited on a monthly or annual basis with passion based upon rises in an equity index. While IUL insurance might confirm beneficial to some, it is very important to understand just how it works before buying a policy.

Table of Contents

Latest Posts

Insurance Company Index

New York Universal Life Insurance

Best Iul

More

Latest Posts

Insurance Company Index

New York Universal Life Insurance

Best Iul